Educational technology, often referred to as EdTech, is the amalgamation of computer hardware, software, and educational principles applied to facilitate learning. EdTech encompasses the practice of integrating technological tools into educational environments to enhance teaching and learning experiences. It aims to improve learning outcomes through the utilization of software, hardware, and digital resources. EdTech companies develop technology-based solutions that aid educators in delivering content, engaging students, and optimizing educational processes by combining the education theory with innovative technological advancements to create effective and effective learning methodologies. Its broad functions are:

- Enhanced Learning: EdTech leverages software and hardware to improve learning outcomes and student engagement.

- Remote Learning: EdTech provides opportunities for remote education, allowing flexible access to educational content.

- Immersive Experiences: EdTech developers create immersive experiences through tools like VR, enhancing understanding in various subjects.

- Innovative Careers: EdTech provides career opportunities for designers, researchers, and developers working on educational tools.

- Interactive Features: EdTech applications offer live classes, assignments, assessments, mock tests, rich UI/UX, and security features.

The various segments in the Indian Edu-Tech industry are listed below.

| Segment | Description |

| K-12 Education | Targeted at primary and secondary school students. Distribution channels: mobile apps, web platforms, video-based content. |

| Test Preparation | Prepares students for entrance exams, primarily for job-focused individuals and undergraduates. – Distribution channels: mobile apps, web platforms, video content, live classes, AI/ML-based assessments, community-based problem solving. |

| Higher Education | For students pursuing higher studies, especially those in areas with limited offline alternatives. Distribution channels: mobile apps, web platforms, video-based content. – Key institutes: Upgrad, Edureka. |

| Skill Development & Certification | Aimed at students looking to learn or update IT skills. Distribution channels: video-based lectures, live classes, online assessments. – Key institutes: Quizizz, Simplilearn. |

| Language & Casual Learning | Targeted at individuals aged 30 to 40 looking to learn languages and basic skills like cooking. – Distribution channels: mobile apps, video-based content, games, face-to-face. – Key institutes: YouTube, Udemy, Tata Sky. |

Market overview

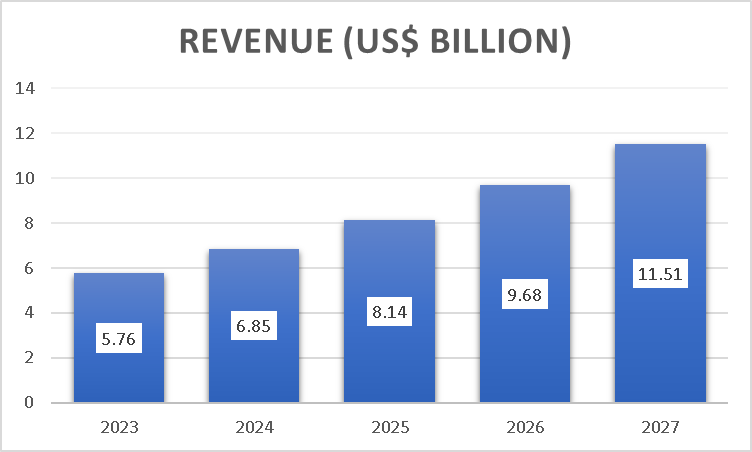

- Revenue of online education market indicates a compounded annual growth rate (CAGR 2023-2028) of 20.53% from the projected revenue of US$5.76 billion in the year 2023, according to market data.

- Current Market Size: In 2022, the Indian EdTech market hit US$2.8 billion, driven by growing internet access and rising demand for online education, according to another market research data.

- Historical Growth Rate: Between 2017 and 2022, the industry witnessed a robust 16.8% CAGR, accelerated by the COVID-19 pandemic’s impact on online learning.

- Future Growth: EdTech is poised to expand, offering K-12, higher education, upskilling, and corporate training. Investment in AI and personalized learning will enhance the learning experience, supported by government initiatives like the National Education Policy 2020.

- Out of 36 Ed-Tech unicorn companies 7 are India based companies which are valued at US$34.05 billion as of June 2022.

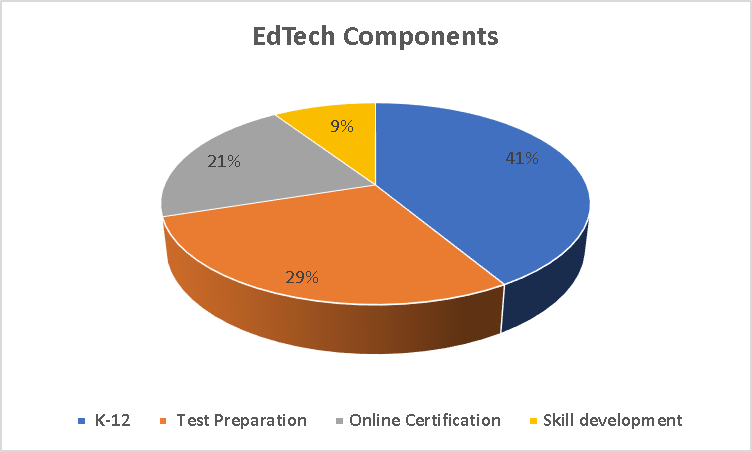

The market value of each sector as reported by different research firms are reported below which gives an indication about the market share of each sector.

- K-12 sector had the market value as US$1.16 billion in 2020 and expected to reach around US$4.3 billion in 2025 Which has CAGR growth of 29.96%.

- Test preparation had the market value of around US$0.80 billion in 2020 and the market is expected to reach around US$3.99 billion in 2025 with a CAGR growth of 37.90%.

- Online Certification had the market value of US$0.58 billion in 2020 and expected to reach US$1.38 billion having a CAGR growth of 18.93%.

- Skill Development was US$2.80 billion in 2020 and the market is expected to reach US$10.40 billion with the CAGR of 22.93%

The five key players in EdTech industry are profiled as below.

| Company | Description | Fundings | Lead Investors | Revenue

growth |

| Career Point | Founder: Pramod Maheshwari

founded in the year 1993. Description: It provides education and EdTech services |

Total Funding Raised $12.5 million | Institutional Investors 3, Franklin Templeton India, Nadathur and Darby Overseas Investments. | Operating revenue

FY 2021 US$ 6.87 Million

FY 2022 US$ 7.12 Million

Annual Growth 3.64% |

| Unacedemy | Company Name Unacademy

Founders Gaurav Munjal, Roman Saini, Hemesh Singh Year of Establishment 2015 Description SaaS-based platform offering multi-disciplinary learning resources and test preparation solutions. Provides structured live courses for students and enables educators to create video courses on the platform. Offers courses for test preparation, academic subjects, language learning, and more. |

Total Funding Raised $881 million over 13 rounds.

First Funding Round December 19, 2015 Latest Funding Round Series H round on August 01, 2021, for $440 million |

Institutional Investors 28, including Blume, Peak XV Partners, Nexus Venture Partners

Largest Institutional Investor SoftBank Vision Fund Angel Investors Vitul Goyal and 33 others |

Operating revenue FY 2021

US$ 47.87 Million FY 2022 US$ 86.49 Million

Annual Growth 80.67% |

| CL Educate | Founders Sujit Bhattacharya, Sreenivasan Ramakrishnan

Year of Establishment 1995 Description CL Educate focuses on diverse segments of education, and across learners of multiple age-groups. |

Total Funding Raised $13.2M million.

|

Institutional Investors 3 institutional investors | Operating revenue

FY 2021 US$ 23.03 Million

FY 2022 US$ 25.95 Millions

Annual Growth 12.68% |

| Upgrad | Company Name UpGrad

Founders Ronnie Screwvala, Mayank Kumar, Phalgun Kompalli, and Ravijot Chugh Year of Establishment 2015 Description App-based platform offering higher education programs for working professionals |

Total Funding Raised $600 million

Latest Funding Round $225 million, June 15, 2022 |

Investors Lupa Systems, ETS, Temasek, Kaizenvest, Bodhi Tree, and 22 other investors | Operating revenue

FY 2021 US$ 36.33 Million

FY 2022 US$ 83.30 Million Annual Growth 129.28% |

| Veranda Learning | Founder Suresh Kalpathi

Year of Establishment 2018 Description Mobile platform for government exam, for bank exam preparation. |

– | – | Operating revenue

FY 2021 US$ 1.88 Million FY 2022 US$ 9.09 Million Annual Growth 383.51% |

Investments In this sector

- The Edu-Tech industry has experienced significant growth during the pandemic period, as schools were compelled to shift their classes online. This presented a favourable opportunity for the ed-tech business to thrive amidst these circumstances, with high demand for their services attracting numerous investors to fund the industry. The funding was well grown in 2021 and so on. Eventually, the pandemic came to an end. The students started attending their offline schools. This slowly reduced the demand in the market which led to investors reducing their exposure to this segment.

- Venture capital investments in India’s edtech sector have increased 32 times over the past 12 years, from 500 million in 2010 to 16.1 billion in 2022 and the sector is expected to reach US$ 30 billion by 2031.

- In 2020, a total of US$1.87 billion was raised in funding. The following year, in 2021, the funding reached US$5.82 billion. As of August 2022, the total funding in the education technology sector amounted to US$2 billion. There is a 65.63% decrease in the investment at the year 2022.

Trends and growth factors

Here are key trends in the Ed tech of late.

- AI-Powered Learning: AI is transforming education in two main ways. First, AI-powered personalized learning tailors educational experiences to individual students by adjusting curricula based on their unique interests and needs, fostering a more effective learning environment. Second, conversational AI, seen in voice-controlled virtual assistants like Alexa, Cortana, and Siri, plays a crucial role in education by providing interactive and accessible support for various tasks. Together, these AI applications reshape education, offering tailored learning experiences and innovative, conversational interfaces that enhance the overall educational process. Edtech companies use AI GPTs for various applications such as interviews, solving math problems and many more.

- Extended Reality (XR)/VR/Virtual labs: Advanced XR technologies further improve interactive learning and support the development of virtual labs. Edtech startup iXRLabs partners with iVAR Lab at IIT Kharagpur to explore for higher education.

- Educational Games: Games like Kahoot! FunBrain, and Race to Ratify engage students in learning subjects they may find less interesting, fostering innovation and engagement.

Market Growth Drivers

There are multiple factors which support the growth of Ed Tech in India. Here are a few such factors.

- Affordable Online Education: Edtech platforms in India offer cost-effective alternatives to traditional education, reducing the financial burden on parents and learners. According to market data, the online skill learning courses are 53% cheaper than offline options.

- Availability of Quality Education: Edtech provides access to high-quality education through online resources. It bridges the digital infrastructure gap in educational institutions, ensuring that students receive up-to-date content created by subject matter experts. The online education market in India is projected to grow significantly, reaching US$2.28 billion by 2025 at a CAGR of nearly 20%.

- Lack of Educational Infrastructure and Qualified Faculty: The expansion of the edtech sector addresses the limitations of physical educational infrastructure by providing intellectual resources like libraries and connecting students with well-qualified teachers. This enables seamless learning without the need for extensive physical school infrastructure.

- Upskilling Demand Among Professionals and Job Seekers: Edtech responds to the upskilling demand driven by automation and job market challenges. Online skill courses are not only affordable but also provide hands-on knowledge, shorter completion times, and flexibility in scheduling for professionals and job seekers.

- Rise in Internet and Smartphone Use: The widespread adoption of smartphones and internet access, with a predicted 1 billion smartphone users by 2026, has made education accessible to students in tier-3 cities and remote areas. They can complete their education and acquire career skills without leaving their homes, thanks to digital-friendly government policies such as Digital India and Skill India.

- The Road Ahead for EdTech: The rise of EdTech enables learning anytime, anywhere. By leveraging technologies like AI, ML, and IoT, edtech institutions are delivering innovative courses digitally at a fraction of traditional costs.

Regulatory framework

The EdTech sector’s emergence in recent years has emphasized the need for a comprehensive regulatory framework. Due to its relatively recent establishment, there is currently a lack of well-defined guidelines and oversight in this rapidly growing industry. To bridge this gap, it is crucial for key stakeholders such as educators, technology experts, policymakers, and industry leaders to collaborate closely and gain a deep understanding of the nuances within the EdTech landscape. By combining their expertise and insights, they can collectively establish a strong regulatory body that fosters innovation, ensures quality, and protects the interests of learners and educators. This regulatory framework will not only enhance the credibility of the EdTech sector but also contribute to its long-term sustainability and positive impact on education worldwide. Amidst that there are few regulations that impacts the sector as listed below.

Intellectual Property Laws: In India, Ed-Tech platforms’ educational content is covered by the Copyright Act 1957, categorizing it as “literary works.” Copyright protection is automatic upon creation, with optional registration serving as evidence of ownership. Trademarks, encompassing logos, product names, and labels, can be safeguarded under the Trademarks Act 1999, with registration offering legal proof; however, unregistered marks also hold protection. While inventions can be shielded under the Patent Act 1970, software, algorithms, and business methods are non-patentable in India, and disclosing unique features can jeopardize patent eligibility. Furthermore, trade secrets and knowledge are safeguarded by common law, necessitating the implementation of agreements and policies to ensure their protection.

Data protection laws: Ed-Tech platforms handle sensitive user data, necessitating robust data security measures to mitigate cyber threats. The Information Technology Act of 2000 falls short in addressing modern tech challenges, leading to the issuance of Data Protection Rules in 2011 by the Indian government. These rules mandate reasonable security practices and require user consent for collecting personal and sensitive data. However, there is a pressing need for broader data protection laws to encompass Ed-Tech platforms located outside India.

Government Initiatives

National Digital Education Architecture (NDEAR): The government announced the establishment of NDEAR in the budget, aiming to create a unified digital infrastructure for education. It is designed to provide students and educators with access to high-quality digital resources.

National Educational Alliance for Technology (NEAT): The NEAT initiative focuses on utilizing technology to provide high-quality online content for various courses. It aims to make e-learning resources accessible to students across the country.

Artificial Intelligence Centres of Excellence: The creation of three AI centres of excellence is a strategic move to promote ‘Make AI for India’ and ‘Make AI work for India.’ These centres encourage industry partnerships for AI training, with the goal of producing a skilled AI workforce, positioning India as an AI industry leader.

Pradhan Mantri Kaushal Vikas Yojana 4.0: The Pradhan Mantri Kaushal Vikas Yojana 4.0 aims to skill hundreds of thousands of youths in the next three years, aligning with the demands of Industry 4.0. It provides training programs covering coding, AI, robotics, mechatronics, IoT, 3D printing, drones, and essential soft skills. The initiative actively promotes enduring industry partnerships to facilitate comprehensive skill development.

Skill India International Centres: Aims to prepare youth for international job opportunities by establishing 30 skill India International centres across various states.

RBI Initiative: RBI will provide hassle free educational loan for the students who wants to do higher education only by showing digital admission letter.

Conclusion

Despite recent setbacks, the Indian Edutech industry still holds numerous opportunities for growth. While some companies have faced bankruptcy and other challenges, the sector continues to thrive due to ongoing innovation. With advancements in technology on the horizon, the industry is poised for further expansion. As the industry is still in its early stages, there is ample room for growth until it reaches its saturation point. Additionally, increased spending driven by rising disposable incomes and government initiatives will contribute to its development. The combination of blended learning, increased adoption of Artificial Intelligence (AI), and integration of other technologies will propel the sector’s rapid growth over the next five years. The activities of emerging startups and ongoing innovation will attract funding from both private investors and the government.

In spite of slight setback in investment and funding due to the burst of the bubble of late, there continues to be a demand for EdTech services in the market. Market data suggests that this sector in India is projected to witness a growth rate ranging from 20% to 35%. With the expected periodical setbacks in change in technology, the industry is expected to demonstrate a Compound Annual Growth Rate (CAGR) of 27.5% in the next five years, from 2024 to 2028.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html